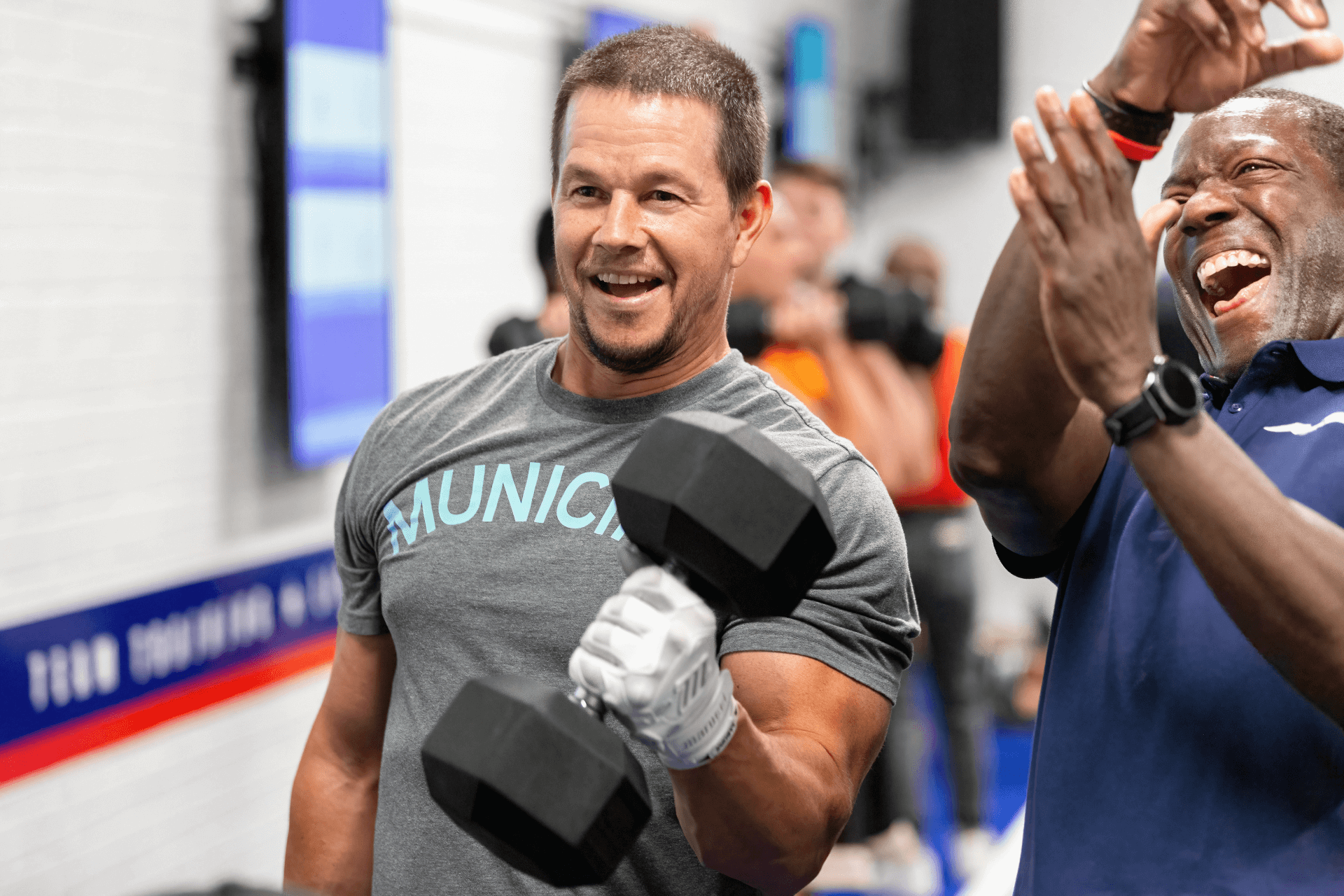

July 7 (Reuters) – Mark Wahlberg-backed fitness chain F45 Training Holdings Inc is eyeing a valuation of more than $1.5 billion in a U.S. initial public offering (IPO), months after terminating its merger with a blank-check company.

The Austin, Texas-based company was founded in 2013 in Australia and now has more than 1,500 studios, with about 2,800 franchises in 63 countries.

F45 said on Wednesday it was aiming to sell about 20.3 million shares priced between $15 and $17 apiece to raise up to $345 million. About 1.6 million shares in the IPO are being offered by the selling stockholder, the proceeds of which would not go to the company.

F45 agreed in June last year to merge with Crescent Acquisition Corp, a special purpose acquisition company, but later canceled the deal as the COVID-19 pandemic shut several of its studios.

It posted an 11% drop in revenue for the year ended Dec. 31, 2020, with its net loss widening to $25.3 million from a loss of $12.6 million a year earlier.

About 86% of the company’s total studios were open as of March 31, according to its filing.

The company is seeking to list on the New York Stock Exchange and will trade under the ticker symbol “FXLV.”

Goldman Sachs and J.P. Morgan are the lead underwriters for the offering. (Reporting by Niket Nishant in Bengaluru; Editing by Aditya Soni)